FOMO Trade - Never Chase a Trade

- Santo

- Feb 9

- 1 min read

ASTS was an example of a trade that I was chasing rather than letting it come to me. It started with not having enough conviction on my it due to its fundamentals although the setup was good early on.

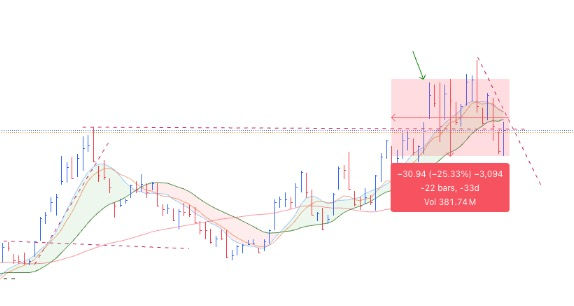

ASTS provided for a few good setups albeit with a large daily range/stop which wasn't conducive for risk taking. Refer to the red shaded cicle in the diagram below.

Even if I planned to buy it, I should chosen the point where the stock broke out of the cup over its previous high at 103ish. The logical stop with the breakpoint was around 88.49 which too high of a stop loss point percentage wise.

I didn't take it but FOMO took me over. And I bought ASTS the next day, as it broke past. I ended up buying at 116.68$ with a stop of previous high 102.80$.

This was 25% from the 21DMA and the stock never gained traction and I stopped out 104.79 soon after losing over 10% in the trade.

Lesson Learnt: Never FOMO on a trade as there are plenty of opportunities in the market.